Which of the following affects one’s Car Insurance Premium?

Your car insurance premium is the amount of money you pay each month to keep your car insurance policy in force. Car insurance affects premiums by several factors, including your driving record, the type of car you drive, your age and driving experience, where you live, and the level of coverage you choose.

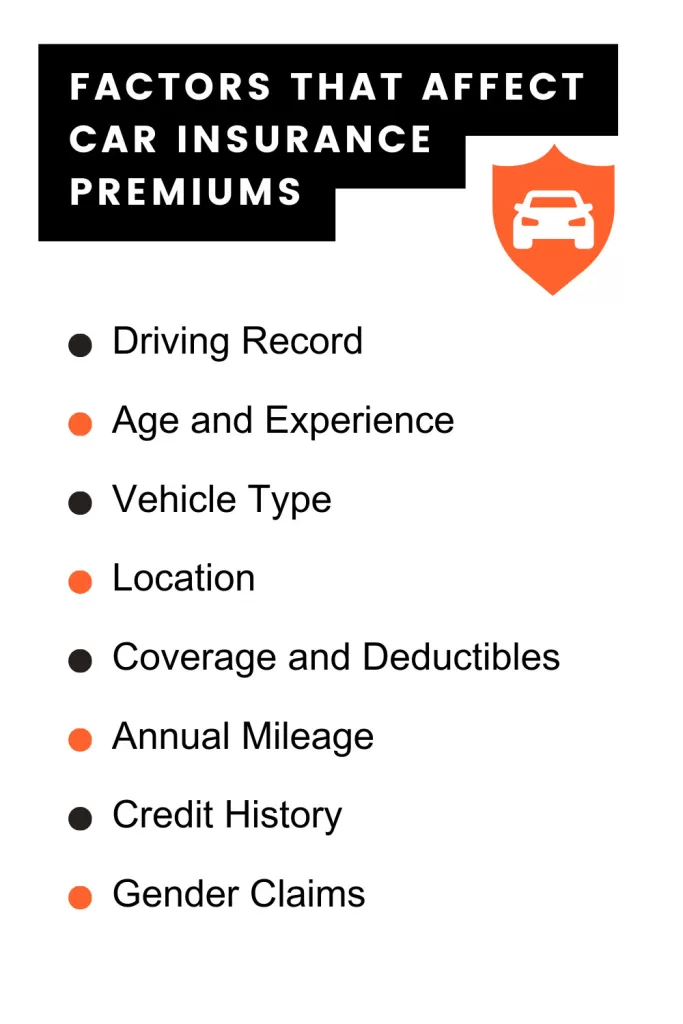

Factors that Affect Car Insurance Premiums in the USA

Driving Record

Your driving record is the most important factor in determining your car insurance premium. Drivers with a clean driving record typically pay lower premiums than drivers with accidents or traffic violations on their record.

Your premium will increase in proportion to the severity of the violation. A DUI conviction, for instance, will significantly raise your rate in comparison to a speeding ticket.

Car Make and Model

Your premium also depends on the type of car you drive. More expensive cars with new technology and advanced safety features typically cost more to insure. Sports cars and luxury cars are also typically more expensive to insure than sedans and minivans.

This is because insurance companies consider the cost of repairing or replacing a car when setting rates.

Also Read: Best Car Insurance Companies: Full Coverage, Low Premiums

Age and Driving Experience

Younger drivers with less driving experience typically pay higher premiums than older drivers with more experience. This is because insurance companies view younger drivers as being at higher risk. As you get older and gain more driving experience, your premium should decrease.

However, there are few exceptions to this rule. For example, if you have a recent accident or traffic violation, your premium may increase regardless of your age or experience.

ZIP code

Insurance companies also consider your ZIP code when setting rates. Rates tend to be higher in areas with higher rates of accidents and theft. This is because insurance companies are more likely to have to pay out claims in these areas.

If you live in an area with a high crime rate, you may want to consider getting additional coverage, such as comprehensive coverage and collision coverage.

Also Read: How Much Does Car Insurance Cost?

Coverage level

The level of coverage you select also affects your premium. Drivers who choose more coverage, such as comprehensive and collision coverage, typically pay higher premiums than drivers who choose less coverage, such as liability coverage.

In most states, liability coverage is the lowest amount of coverage mandated by law. In the event that you cause an accident, it pays for injuries and property damage to other persons.

Collision coverage pays for damage to your own car in the event of an accident, regardless of who is at fault.

Comprehensive coverage pays for damage to your car caused by things other than accidents, such as theft, vandalism, and weather events.

You can also choose to add additional coverage to your policy, such as rental car reimbursement coverage and uninsured motorist coverage.

Also Read: 13 Types of Car Insurance that You Can Buy

Other factors

In addition to the factors listed above, there are a few other factors that may affect your car insurance premium. These factors include:

It is important to note that not all insurance companies weigh these factors the same. It is important to shop around and compare quotes from multiple companies to find the best rate for you.

How to lower your car insurance premium

There are a few things you can do to lower your car insurance premium:

- Maintain a good driving record. This is the best way to lower your premium. Avoid accidents and traffic offenses to keep your driving record clean.

- Choose a less expensive car to insure. More costly cars generally cost more to insure. If you are looking to save money on your premium, consider choosing a less expensive car to insure.

- Increase your deductible. A higher deductible will lower your premium, but it will also mean you have to pay more out of pocket if you have an accident.

- Shop around and compare quotes from multiple companies. Different insurance companies have different rates, so it is important to shop around and compare quotes to find the best rate for you.

- Ask about discounts. Many insurance companies offer discounts for things like good driving records, safety features, and bundling your car insurance with other types of insurance.

By following these tips, you can save money on your car insurance premium without sacrificing coverage.

Also Read: 7 Best Ways to Lower Car Insurance

Additional tips

Here are some additional tips on how to lower your car insurance premium in the USA:

It’s also important to note that your car insurance premium may change over time. For example, if you get older, gain more driving experience, or move to a safer area, your premium may decrease. However, if you have an accident or traffic violation, your premium may increase.

By following the tips above, you can save money on your car insurance premium without sacrificing coverage.

FAQ

Which of the following affects one’s car insurance premium apex?

Car insurance premiums are influenced by driving record, age, vehicle type, location, coverage, annual mileage, credit history, and gender, as well as claims and insurance coverage history.

Conclusion

It’s important to note that the importance of these factors can differ between insurance providers and regions. Comparing offers and maintaining safe driving habits are advisable to secure It’s important to note that the importance of these factors can differ between insurance providers and regions.

Comparing offers and maintaining safe driving habits are advisable to secure the best car insurance rates.